NOTE: Applications are no longer being accepted. For information about a pending application, please email restartebr@urbanleaguela.org

Mayor-President Sharon Weston Broome and the City of Baton Rouge, East Baton Rouge Parish recognize the challenges that local businesses are facing as a result of the COVID-19 pandemic. To meet the short-term financial needs of microenterprises and small businesses, the Resilient Restart EBR: Small Business Micro-grants Program offers one-time, micro-grants of $2,500 to eligible entities that have been impacted by COVID-19. Recipients may use these funds for rent, utilities, inventory, accounts payable, fixed costs, employee wages and benefits. These are grant awards and repayment by the recipient is not required.

This program is activated by the CARES Act administered through the Department of Housing and Urban Development’s Community Development Block Grant Program with an additional infusion of funding from Investar Bank. Applications for micro-grants will be reviewed and awarded on a rolling basis until all allocated funds are dispersed. This program is being administered by the Urban League of Louisiana.

Applicants should gather all required documentation prior to starting the application form.

WHO: Existing Small Business and Microenterprise Owners

WHAT: One-time, micro-grants of $2,500 to eligible entities that have been impacted by COVID-19.

BONUS: These are grant awards and repayment by the recipient is not required.

Eligible firms must be:

- a small business as defined by SBA size standards, an independent contractor, or a self-employed individual

- at least 51% owned by an individual(s) that resides in East Baton Rouge Parish and is confirmed as a LMI individual; or at least 51% owned by an individual(s) that resides in East Baton Rouge Parish and operating a business in a LMI census tract in East Baton Rouge Parish

- a small business with a principal place of business located, operating, and registered to do business in East Baton Rouge Parish

- a small business in operation for the full year of 2019, or the 12 months prior to March 11, 2020

- a small business with gross revenue of no more than $250,000 in 2019, or the 12 months prior to March 11, 2020

- a small business with no more than 15 full-time employees (as of March 11, 2020); and

- able to demonstrate a loss of business revenue related to COVID-19

NOTE: Special consideration will be given to minority, women, veteran, and service-disabled veteran-owned firms. Special consideration will also be provided to businesses that provide medical, food delivery, cleaning, and other services to support home health and quarantine, as well as, those that manufacture or source Personal Protective Equipment (PPE) like masks, gloves, head coverings, and other medical supplies to respond to infectious disease.

Ineligible Businesses

Ineligible firms include:

- Non-profits

- Churches

- Charitable organizations

- Liquor stores

- Bars and night clubs

- Adult entertainment venues

- Adult book stores

- Banks and other financial institution

- Rental properties

- Firearm dealers

- Social clubs

- Payday lenders

- Tobacco shops

- Home-based businesses with more than 6 employees

- E-commerce or online only businesses with more than 6 employees

- Other business types as determined ineligible by the City of Baton Rouge, East Baton Rouge Parish.

Required Documentation

All applicants must provide the following documents to be considered for an award.

- Resilient EBR: Small Business Micro-grants Program Application

- Confirmation of Federal Employer Identification Number (EIN) or Social Security Number

- Confirmation of DUNS Number – Obtain a Government DUNS

- Documentation of the business owner or owners’ state residency (such as a driver’s license or a bill) – PHOTO files acceptable.

- Verification of an active SAM.gov registration with no exclusions (https://www.sam.gov/SAM/)

- 2019 federal tax return (Personal returns will be accepted for independent contractors and self-employed individuals.)

- 2019 income statement – Click Here for a Free Template if Needed

- 2020 income statement – Click Here for a Free Template if Needed

- IRS Form W-9 (October 2018 Version) – Click Here to Download

- Other supporting documents as requested

TWO STEP APPLICATION PROCESS

Applications are no longer being accepted. For information about a pending application, please email restartebr@urbanleaguela.org

Technical Assistance

The Resilient EBR Program offers access to entrepreneurial support services to micro-grant recipients, including: small business education, one-on-one business counseling, and access to resources for business growth, profitability, and scalability.

The Urban League of Louisiana’s Center for Entrepreneurship & Innovation will provide these small business development services at no cost to all grant recipients. Direct support services also include: comprehensive business planning and support, loan packaging, business certifications, and assistance with operational streamlining, business financials and accounting. To access these services, grant recipients must complete and submit the ULLA Client Intake Form by visiting https://tinyurl.com/yd4ltn9t.

For questions regarding the Resilient Restart EBR: Small Business Micro-grants Program, please contact the Urban League of Louisiana at restartebr@urbanleaguela.org.

For questions regarding the Resilient Restart EBR: Small Business Micro-grants Program, please contact the Urban League of Louisiana at restartebr@urbanleaguela.org.

Frequently Asked Questions

How do I determine my eligibility?

The Resilient Restart EBR Program will support small business owners who are classified as low-to-moderate income individuals based on HUD guidelines, as well as, those that own and operate a business in a low-to-moderate census tract in East Baton Rouge Parish. In addition, special consideration will be given to eligible minority-, women-, veteran-, and service-disabled veteran-owned firms.

Low to Moderate Income Individuals

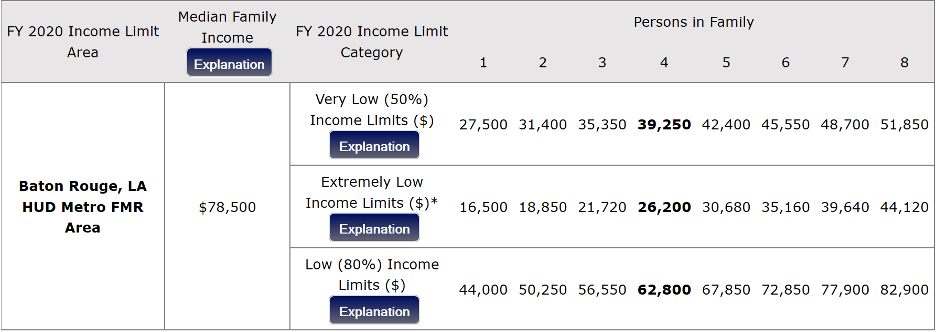

LMI individual income limits for the Baton Rouge MSA for FY 2020 are noted here.

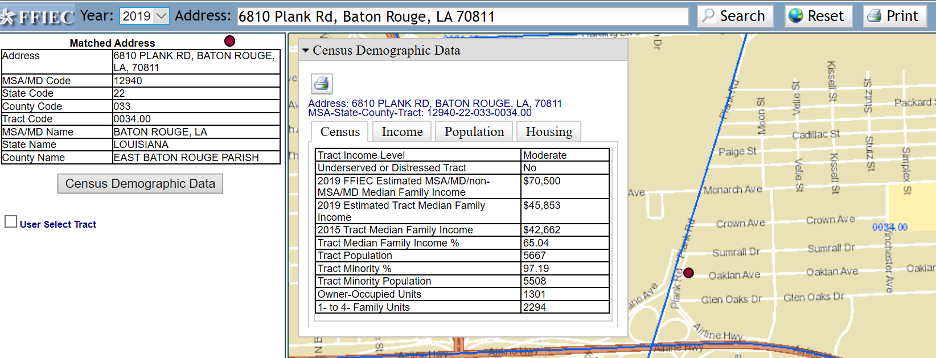

LMI Census Tracts in Baton Rouge Parish

To determine if a business is operating in a LMI census tract in Baton Rouge, applicants can access the Federal Financial Institutions Examination Council’s (FFIEC) Web Site which offers a Census and Demographic Data tool. The applicant must enter the business address to determine if it is located in an LMI census tract.

Can the grant funds be used for business repairs?

No, this grant cannot be used for any construction-related work for your business (e.g. painting, electrical, plumbing, or carpentry).

What types of businesses are ineligible for this program?

Ineligible firms include non-profits, churches and other charitable organizations, liquor stores, bars and night clubs, adult entertainment venues, adult book stores, banks and other financial institutions, rental properties, firearm dealers, social clubs, payday lenders, tobacco shops, and other business types as determined ineligible by the City of Baton Rouge, East Baton Rouge Parish. In addition home-based businesses and e-commerce or online only businesses with more than 6 employees are not eligible for a micro-grant award.

My business is home-based. Am I eligible to apply?

Home-based businesses are only eligible if there a 5 or fewer employees and meet the remaining requirements for a microenterprise business. Home-based businesses with 6 or more employees are not eligible for this grant.

My business is online only. Am I eligible to apply?

E-commerce or online only businesses are only eligible if there a 5 or fewer employees and meet the remaining requirements for a microenterprise business. E-commerce or online only businesses with 6 or more employees are not eligible for this grant.

I have lost or misplaced my EIN. How can I obtain it?

If you do not remember, have lost or misplaced your EIN, please visit the following IRS website to obtain guidance. https://www.irs.gov/businesses/small-businesses-self-employed/lost-or-misplaced-your-ein

I do not have a DUNS number. How do I get one?

In order to apply for a DUNS number related to federal funding, visit www.dnb.com/govtduns to complete the application. Before getting started, you will need to gather 2 documents to complete this process. The documents must match the Correct Legal Business Name at the Current Physical Address. (See examples of accepted documents below).

For Sole Proprietorship companies, ensure that the documentation contains Your Full Legal Name and Current Physical Address.

Examples of Accepted Documents

(Do Not Include personal information such as Driver’s License, Passport, Social Security, Banking Statements, etc.)

Create New D-U-N-S

Example of Accepted Documents for New D-U-N-S

– Secretary of State Articles of Incorporation

– Taxpayer Identification Number (TIN) Confirmation Letter

– Employer Identification Number (EIN) Confirmation Letter

– DBA / Assumed Name Certificate Filing

– Lease Agreement

– Utility Bill

Update or Correct DUNS

Example of Accepted Documents for Business Name Change:

– Secretary of State Articles of Incorporation

– Registration Amendment Document

– Taxpayer Identification Number (TIN) Confirmation Letter

– Employer Identification Number (EIN) Confirmation Letter

– DBA / Assumed Name Certificate Filing

– Merger / Acquisition Agreement

– Purchase Order Representing Asset / Liability Exchange

Example of Accepted Documents for Address Change:

– Utility Bill

– Lease Agreement

– Taxpayer Identification Number (TIN) Confirmation Letter

– Employer Identification Number (EIN) Confirmation Letter

– Invoice from a third party showing current Business Name and Address

Example of Accepted Documents for Ownership Change:

– Probate document authorizing ownership of business

– Operating Agreement

– Merger / Acquisition Agreement

– Partnership Agreement

– Purchase Agreement

Who do I contact if I have questions about the program and/or the application process?

For questions regarding the Resilient Restart EBR: Small Business Micro-grants Program, please contact the Urban League of Louisiana at restartebr@urbanleaguela.org.

I received a notice that I was awarded the micro-grant award. How will funds be dispersed and when should I expect to receive it?

Congratulations! Disbursements will made by paper check and mailed to the business address cited on your firm’s submitted W-9 form. Please allow at least 7 to 10 business days after your award confirmation for receipt of funds.

The online application form that I submitted had an error in it. How can I correct this?

Please submit any updated information to your original application or additional documents to restartebr@urbanleaguela.org with Application Update + The Applicant’s Name in the Subject Line. You will receive a confirmation email once we have applied these updates to your original application.

I forgot to attach a document to my original email submission? How can I send this document to be added to my application?

Please submit any updated information to your original application or additional documents to restartebr@urbanleaguela.org with Application Update + The Applicant’s Name in the Subject Line. You will receive a confirmation email once we have applied these updates to your original application.

Summary of Eligible Businesses

I own a business entity having 5 or less employees. (includes independent contractors and self-employed individuals)

You own a Microenterprise

- At least 51% of the business is owned by an individual(s) that resides in East Baton Rouge Parish and is confirmed as a LMI individual

- The principal place of business is registered to do business in East Baton Rouge Parish.

- The business entity is in good standing with the Louisiana Secretary of State.

- The business entity has gross revenue of no more than $250,000 in 2019, or the 12 months prior to March 11, 2020.

- The business owner has a loss of business revenue related to COVID-19.

I own a business entity having between 6 and 500 employees.

You own a Small Business

- The business operates in an LMI census tract in East Baton Rouge Parish

- The business provides direct services to residents in LMI census tracts in East Baton Rouge Parish (e.g. barber shops, nail salons, restaurants, retail shops, etc.).

- The principal place of business is registered to do business in East Baton Rouge Parish.

- The business entity is in good standing with the Louisiana Secretary of State.

- The business entity has gross revenue of no more than $250,000 in 2019, or the 12 months prior to March 11, 2020.

- The business owner has a loss of business revenue related to COVID-19.